FROSTOPUS: Referral Fees, Broker Rules, & the Role of Nathaniel Darnell

I recently spoke with Georgia attorney Craig Kuglar, who represents investors caught up in the collapse of First Liberty Capital. The SEC says this was a Ponzi scheme run by Brant Frost IV, who we call “Quattro.” But it was Brant Frost V, or Cinco, who personally reached out to potential investors, including Peach Pundit contributor Jason Shepherd, in an effort to recruit the latter into investing or referring investors into the scheme.

One of Kuglar’s clients says she was referred to the Frosts by Nathaniel Darnell, a licensed securities broker and the current president of the Georgia Republican Assembly. That allegation carries serious legal and regulatory weight and is why Kuglar is investigating Darnell’s involvement.

To explain it all, Craig broke down the legal avenues into three distinct lanes. First is the SEC’s role in stopping the operation, freezing assets, and initiating receivership. The goal here is to stop the bleeding and prevent any new investors from getting snookered.

The second is the criminal side, where the Department of Justice would pursue charges like wire fraud, which US Prosecutor, BJay Pak, walked us through in the most recent episode of the podcast.

The third lane is where Kuglar focuses his work. This involves suing individuals who promoted the scheme but were not named in the SEC complaint, such as people in trusted positions like CPAs, financial advisors, or licensed brokers. Many of them are not protected by the litigation stay in the civil case, and Craig’s goal is to help investors recover funds from these peripheral players and the firms that failed to supervise them.

A litigation stay is basically a legal freeze that prevents anyone from suing the Frosts separately. When the SEC brings a case like this one, the court often puts a stay in place to stop other lawsuits from piling on while a receiver sorts through the mess. It keeps everything from turning into a feeding frenzy that drains whatever money might be left for victims. The stay only applies to the people and companies named in the SEC’s case, think Quattro, Cinco, and First Liberty itself. It doesn’t protect folks on the outside who might have helped pull others in.

That’s where civil attorneys like Craig Kuglar come in. They go after the trusted advisors who weren’t named in the SEC complaint but still played a role in the scheme.

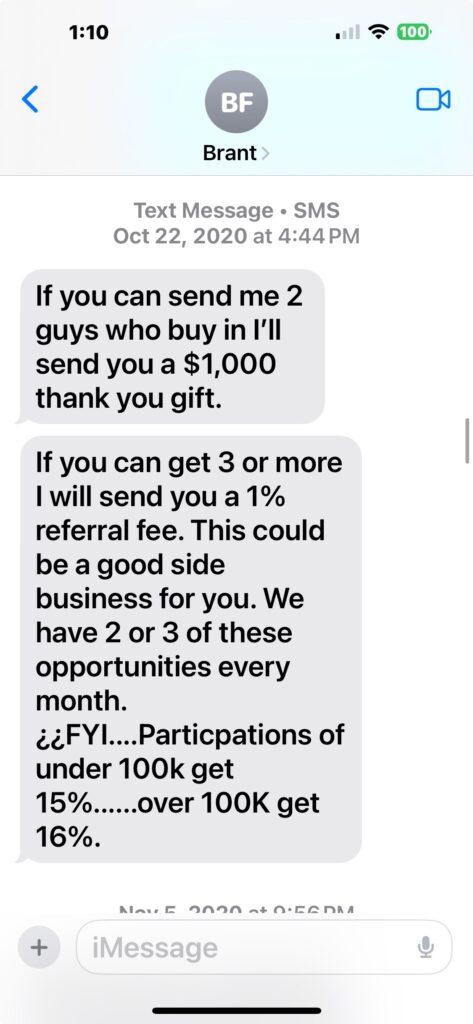

This is not just theoretical. Jason Shepherd received a series of texts from Cinco between 2019 and 2020, soliciting investments into First Liberty. The pitch started small, offering a $250 gift card for a referral. That increased to $500, and eventually Cinco was offering a full one percent commission for referred investments. He even suggested this could be a solid side business for Shepherd, claiming there were two or three of these opportunities each month.

This kind of arrangement is not just sketchy, it’s illegal. You cannot get paid to refer someone into an investment unless you are a licensed broker. And if you are a licensed broker, you cannot engage in that kind of activity without disclosing it to your firm and getting approval. Doing it on the side is what’s called “selling away,” and it’s a serious regulatory violation. Broker-dealer firms like Bankers Life, where Darnell is registered under the name Timothy Nathaniel Darnell, are required to supervise their agents. If they miss something like this, they can be held liable too.

Some folks might try to claim that as long as they didn’t take a commission, they’re in the clear. That’s not how it works because FINRA rules don’t just apply when money changes hands. If you’re a licensed broker, you’re not allowed to steer people toward investments your firm hasn’t approved, even for free. Recommending unvetted deals, lending your name to them, or making introductions behind your firm’s back can still land you in hot water.

Selling away is a violation whether you got paid or not. The rules are there to protect investors from thinking a deal has been vetted just because it came from someone with a license. Intent doesn’t matter as much as the risk created.

And firms like like Bankers Life are required to monitor for exactly this sort of thing. They have what is called a duty of supervision. If they ignore it or fail to detect it, they can also be held responsible.

That duty of supervision can go pretty deep when there’s reason to be concerned. If a firm sees signs that one of their agents is involved in outside investment activity, they’re not just allowed to dig, they’re expected to. That can include requesting access to personal bank records, emails or other correspondence, looking for undisclosed income, or tracing whether a broker is receiving referral payments off the books. FINRA has made it clear that when red flags show up, firms have a responsibility to follow the trail. Turning a blind eye isn’t a defense, it’s negligence. And when investors get hurt, that lack of oversight can come back to bite the firm just as hard as the broker who did the selling.

To be clear, Jason Shepherd never accepted Cinco’s offer. He made no referrals, received no money, and did not invest. When the Ponzi scheme came to light, he turned the messages over to the authorities. He will not be writing further on the matter until legal proceedings are complete just in case he is called as a witness in the case.

But the texts are real. Cinco offered money for referrals, and he did so repeatedly. Which brings us back to Darnell. We know one of Craig Kuglar’s clients says she was referred by Nathaniel Darnell. And while we do not yet know whether Darnell received compensation, here is what matters: under FINRA rules, the referral itself is a potential violation, whether he got paid or not.

And it isn’t like Kuglar’s client is alone in this scenario. Allegedly Darnell was so prolific at referring clients to the Frosts that the Wolper Law Firm, which represents defrauded investors, has launched its own investigation into the Frost operation. Their site describes the scheme as a textbook Ponzi structure that used a network of both registered and unregistered sales agents to sell fake investment products. And they name names.

Wolper says they have already heard from Bankers Life clients (plural) who claim they were referred into First Liberty by Financial Advisor Timothy Nathaniel Darnell. If true, that means a licensed representative of a FINRA-member firm may have helped feed an untold number of retail investors into the Frostopus. And under the law, that means the firm could be financially responsible for failing to supervise one of their own.

We asked Darnell for comment. Here is his unedited response, which did not answer my questions to him, which I will post below. Also, I am choosing to not publish the nonsensical resolution the GRA passed in an attempt to distance themselves from the PAC that bore their name and was funded by monies, allegedly, from the Frostopus. You can read about that more in a recent post from Sam Thomas.

Hello, Scot:

It is shocking and appalling what happened with First Liberty. My family are among the victims who were deceived and who entrusted money into their loan agreements. Along with many other victims, we are awaiting instructions from the Receiver on how to process our claims to attempt to get our money back.Also, like the Georgia Republican Party and many individual Republicans across the state, we trusted the Frosts and their reputations over the last 38 years in their business. We heard many good reports from respected people across the state who vouched for them. In my conversations with them, we never were given any reason to believe that their business had turned into a Ponzi scheme. If we had, my family obviously would not have entrusted any money to them. We feel betrayed.

We hope all the victims of this deception from First Liberty will recover. As for the GRA, you can read the official statement (attached) from the GRA that was passed unanimously by the GRA Board at our most recent Board meeting.

Sincerely,

Nathaniel Darnell

This story stopped being about one bad actor a long time ago. Now the focus is shifting to the network that helped enable it, whether by silence, sloppiness, or something worse. Because it is also about where the money came from, who helped, and how it was spent. When Buzz coined the term Frostopus, he was dead on because this thing has many tentacles and it goes in every imaginable direction.

Stay tuned. There is so much more.

The questions I sent to Nathaniel Darnell yesterday, and again, as you can see, he did not answer any of them.

Dear Mr. Darnell,

Peach Pundit is preparing a story related to the SEC’s civil complaint involving Brant Frost V (Cinco), First Liberty Capital, and what federal regulators have described as a Ponzi scheme. Multiple victims and legal sources have raised your name in connection with referrals made to this investment fund.

In the interest of accuracy and fairness, we’d like to offer you the opportunity to respond to the following questions before publication:

Background & Affiliation

- Were you ever affiliated in any formal or informal capacity with First Liberty Capital, First Liberty Building & Loan, or any related Frost-controlled entities?

- Did you ever receive compensation, commissions, gifts, or referral bonuses from Brant Frost V or his companies in exchange for directing individuals to invest in First Liberty?

- Did you ever refer or recommend the First Liberty investment opportunity to anyone, including fellow members of the Georgia Republican Assembly (GRA)?

Licensing & Oversight

- Are you currently, or were you at the relevant time, a licensed Series 7 broker or otherwise registered with FINRA?

- If so, what firm were you affiliated with during the time referrals may have taken place?

(Public records suggest Bankers Life, but we’d like your confirmation.) - Were any of your activities related to First Liberty disclosed to your supervising firm as required under industry rules?

- Are you aware that such activity could trigger liability under state and federal securities laws for unregistered broker-dealer activity or failure to disclose outside business activities?

Political Nexus

- As a leader in the Georgia Republican Assembly, do you believe it was appropriate for Brant Frost V to solicit fellow activists and GRA members into an unregistered investment vehicle offering unusually high returns?

- Were you aware that First Liberty funds or other Frost business money was used to fund GRA PAC activity?

Looking Forward

- Do you intend to cooperate with investigators or the SEC-appointed receiver in any way?

- Would you like to offer a statement to those who may have invested based on your involvement or referral?

We welcome your response by Noon on Wednesday, July 30th and will include your comments in our upcoming coverage. Please note that if you decline to comment, we will note that as well.

Sincerely,

Scot Turner

Editor, Peach Pundit

To visit the Receiver’s website where he is tracking the Frostopus, click here.