It’s Not Just Dublin City Schools That Have Missed Financial Audit Reporting Deadlines.

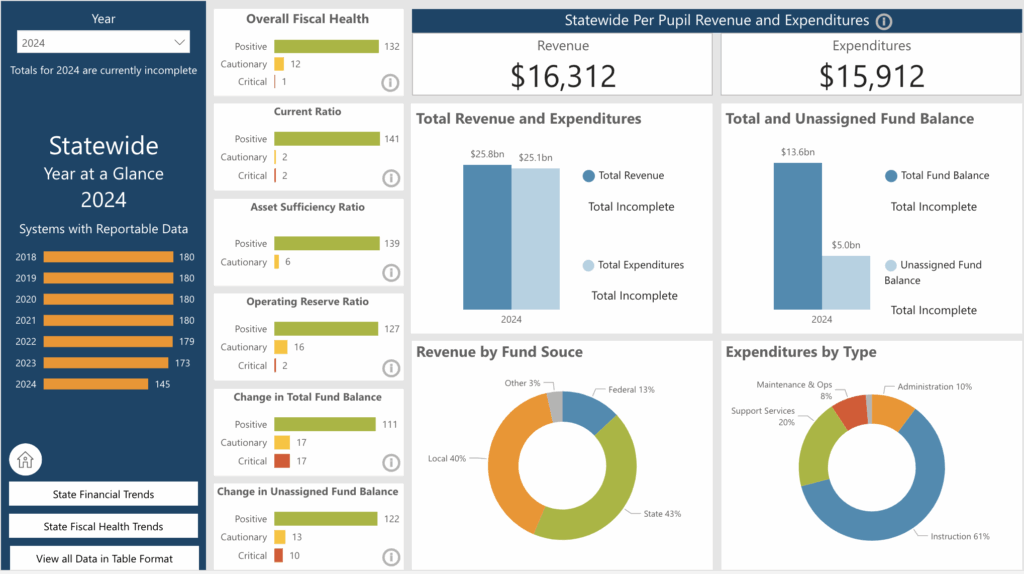

The image above is from this Department of Audits website. As of October 1, 2025 seven of Georgia’s 180 school districts haven’t yet submitted their FY2023 financial audits to the DOAA as required by law. Per O.C.G.A. 36-81-7, local governments, including school districts, have 180 days from the end of their fiscal year to provide DOAA with this information. The fiscal year having ended June 30th, systems have until the last week of December to remain compliant with the law. To the 145 districts that have already submitted their FY2024 reports, well done.

As the chart shows, one system still hasn’t provided its 2022 financial audit. We can assume this is Dublin City Schools, which finds itself in a very bad financial place, as we told you about last month.

We don’t know which other local school systems are delinquent on their 2023 report. However, diligent readers of their local legal organ might have noticed delinquent districts publishing their failure to comply, assuming they would comply with paragraph f of O.C.G.A. 36-81-7, which states:

Upon a failure, refusal, or neglect to have an annual audit made, or a failure to file a copy of the annual audit report with the state auditor, or a failure to correct auditing deficiencies noted by the state auditor, the state auditor shall cause a prominent notice to be published in the legal organ of, and any other newspapers of general circulation within, the unit of local government. Such notice shall be a prominently displayed advertisement or news article and shall not be placed in that section of the newspaper where legal notices appear. Such notice shall be published twice and shall state that the governing authority of the unit of local government has failed or refused, as the case may be, to file an audit report or to correct auditing deficiencies, as the case may be, for the fiscal year or years in question. Such notice shall further state that such failure or refusal is in violation of state law.

As far as I can tell, this is the only penalty for failing to follow these financial reporting laws.