Georgia Shouldn’t Punish Corporate Critics, But It Should Break It’s Addiction To Special Tax Breaks.

Late in the afternoon on Sine Die Delta Airlines issued a statement condemning the passage of SB 202, the Election Integrity Act of 2021. As you might imagine, this angered many Republicans in the Legislature who began looking for a vehicle to remove a jet fuel tax exemption Delta currently enjoys. Such a vehicle was found and the House approved the elimination of the exemption. Time expired before the Senate took up the bill, thus Delta still benefits from the jet fuel tax exemption. However, the debate over this issue continues. Should Legislators retaliate when they feel unfairly attacked? Is this a matter of free speech for corporate leaders, or are corporate leaders becoming agents of (in this case at least) the Democratic Party and Stacey Abrams’ potential campaign for Governor?

I have my own views on those questions, but let me suggest a different approach: eliminate most, if not all, of Georgia’s sales tax exemptions (not classified as business inputs), and significantly cut the personal and corporate tax rate. In my view, this would be better public policy, remove leverage some legislators and corporate leaders feel they currently have against each other, and provide more fairness to more Georgians.

In the summer of 2010, the Legislatively created “Special Council on Tax Reform and Fairness for Georgians” took a deep look at Georgia’s tax system with the goal of seeing legislation passed to reform the tax code in 2011. A report was issued with a number of recommendations. I was excited by the work of the Council and attended several of the public meetings. As a naive incoming freshman Legislator, I anxiously awaited the forthcoming legislation, which landed with a thud and died quietly in the darkness.

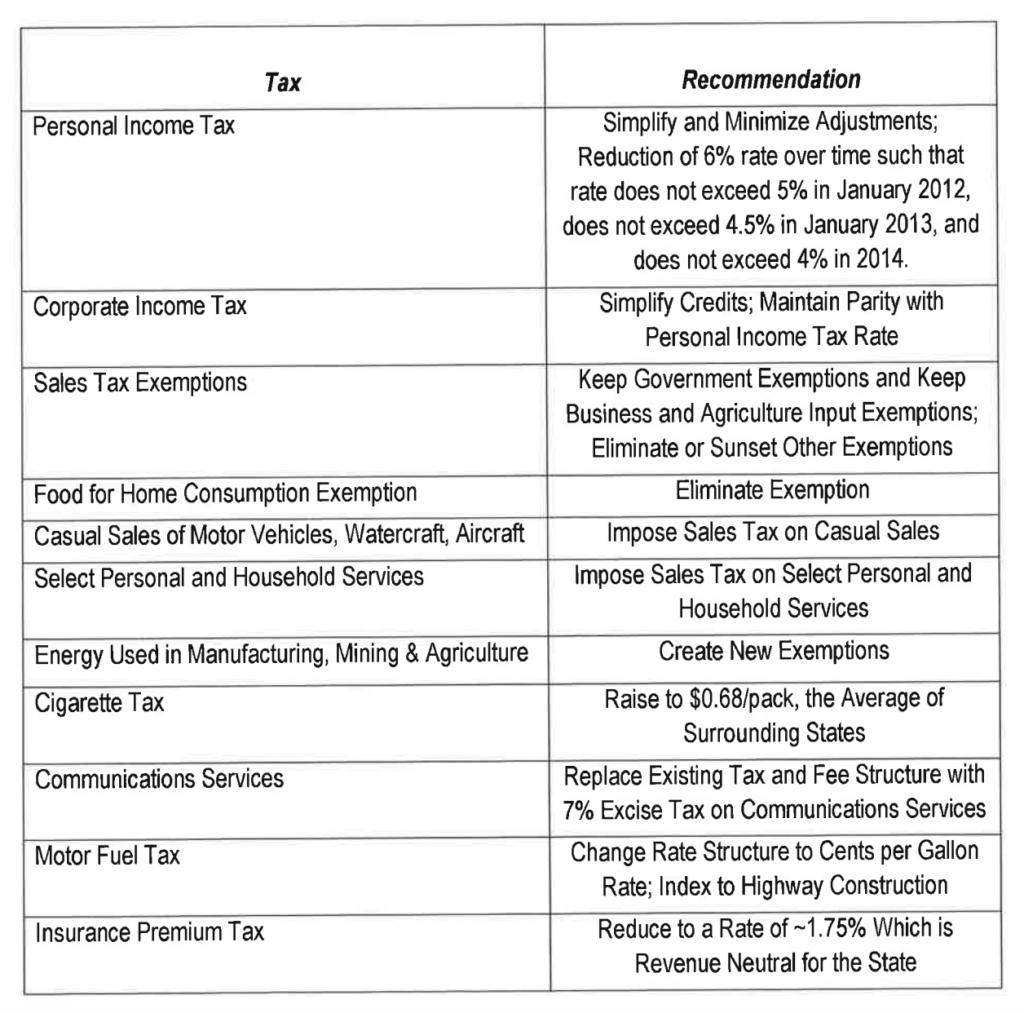

General reforms proposed by the Special Council for Tax Reform and Fairness:

Georgia has a very large number of sales tax exemptions such as the jet fuel tax exemption Delta currently enjoys. Wouldn’t it be better to debate whether or not this exemption is a business input as opposed to whether or not Delta has behaved well enough to continue receiving the credit? I imagine there would be broad bi-partisan support for lowering the temperature around these issues.

It’s impossible to remove politics from politics, but having a framework to examine current and proposed sales tax exemptions would be of great benefit to thoughtful lawmakers. During my time in the Legislature, we created numerous new sales tax exemptions. I tried to be consistent and only support these proposals when they exempted business inputs, but I’m sure I missed the mark sometimes.

I don’t agree with everything the Council proposed, but it’s a good place to start. There are tax credit and exemptions I think are beneficial and should be allowed to continue. Most certainly, an examination of which exemptions actually provide a net benefit to the people of Georgia is in order. However, I strongly support the overall approach outlined in this report. While Georgia’s state level tax burden is relatively light, two of our neighbors (TN and FL) have no income tax at all. A 4% corporate and personal tax rate, combined with our otherwise business friendly environment would be a powerful tool in the toolbox of our economic development folks.

Every tax exemption has a constituency behind it, and removing the dozens and dozens of sales tax exemptions and tax credits that currently exist would be an enormous political lift. Nevertheless, Georgia’s economy, and political climate would be greatly improved.

Well written as always, Buzz.